China Nonwovens and Industrial Textiles Association (CNITA)

As considerable materials for industrial textiles, nonwovens have been widely used in medical, healthcare, filtration, construction, transportation, wipes, packaging, agriculture, etc, and have made significant contributions to human lives and economic/social development.

In 2023, affected by geopolitics, adjustment of global industrial chain and supply chain, and intensified market competition, China nonwovens industry has experienced fluctuations in sales, exports and economic benefits, but production and demand have shown signs of gradual recovery.

1. Production

According to the statistics of CNITA, the output of nonwovens in China in 2023 was 8.143 million tonnes, a year-on-year increase of 0.1%.

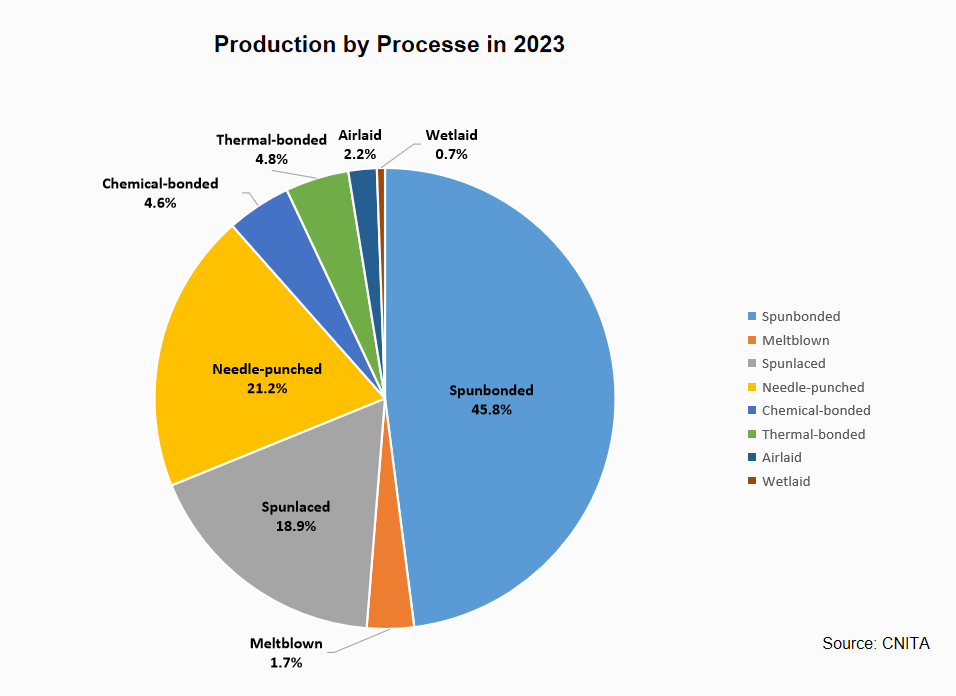

Spunbonded, needle-punched and spunlaced are still the main processes for nonwovens in China in 2023. Among them, spunbonded nonwovens output decreased by 7.1% year-on-year to 3.87 million tonnes due to the decline in demand for medical, healthcare and hygiene use. The market demand for needle-punched nonwovens kept growing due to the growth of applications in construction, building, automotive and environmental protection. The output of needle-punched nonwovens increased by 8.3% year-on-year to 1.73 million tonnes. The rapid development of nonwoven wipes has driven the growth of spunlaced nonwovens. The output of spunlaced nonwovens reached 1.54 million tons, up 7.7% year-on-year. The output of meltblown nonwovens was 140,000 tonnes, down 47.8% year on year, as the market demand for anti-pandemic materials has dropped significantly in 2023.

2. Investment

In 2023, China nonwoven companies were still cautious about investment in new production lines. According to CNITA’s survey, more than 45% of the companies did not invest in nonwovens in 2023. CNITA incomplete statistics showed that 45 spunbonded and meltblown nonwovens production lines, 25 spunlaced lines and 135 needle-punched lines were newly installed in 2023, with a total new production capacity of more than 850,000 tonnes.

Since 2021, companies have become more rational in their investment, with high-end, intelligent and green becoming the main trends of new lines investment in nonwovens industry. In 2023, the investment in high-speed spunbonded and meltblown composite lines, bi-component spunbonded lines and wood pulp based spunlaced lines continued to grow, which will further improve and optimize the structure of China nonwovens industry.

3. Export and import

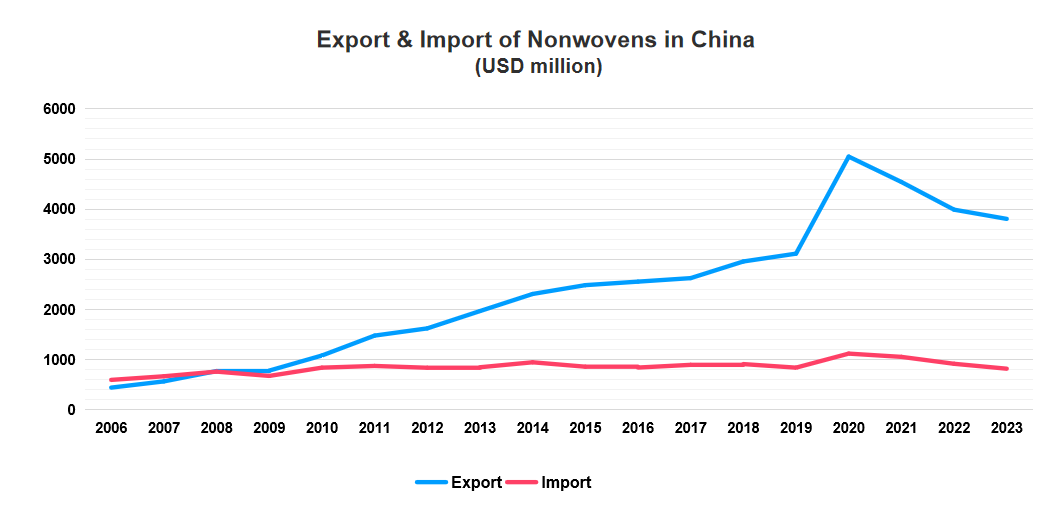

In 2023, China exported 1.31 million tonnes of nonwovens rolls, up 9.1% year-on-year, valued at $3.81 billion, down 3.1% year-on-year, but export value were still 22.4% higher than in 2019. The decline in export value in 2023 was mainly due to the decline in rolls export prices, which were decreased 11.8% compared to 2022.

In terms of process, in 2023, the export share of spunbonded and spunmelt composite nonwovens was 35.3%.. The rest of the exported nonwovens were all made of short fibers, of which weight between 25g/㎡and 70g/㎡ have the largest export value, with $1.17 billion in 2023, accounting for 30.9% of the total nonwovens exports.

Vietnam, South Korea, Japan, the United States and Indonesia are the main importers of China's nonwovens. In recent years, Vietnam has become the largest importer for China's nonwovens, with imports from China amounting to $330 million in 2023, down 16.9% year-on-year.

China's nonwovens exported to South Korea and Japan declined by 8.9% and 11.9%, respectively, and exported to the United States declined by 4.3% year-on-year in 2023. Despite the decrease in demand for China's nonwovens in main importers, exports to Russia increased by 25.9% year-on-year, and exports to Mexico and Italy also increased by 8.3% and 5.4%, respectively.

Main Importers of China’s Nonwovens in 2023

|

Countries

|

Value (USD million)

|

Growth Rate (%)

|

|

Vietnam

|

325

|

-16.87

|

|

South Korea

|

313

|

-8.90

|

|

Japan

|

308

|

-11.94

|

|

USA

|

254

|

-4.29

|

|

Indonesia

|

129

|

-17.57

|

|

Russia

|

116

|

25.89

|

|

Philippines

|

113

|

-6.64

|

|

Mexico

|

103

|

8.28

|

|

Malaysia

|

96

|

-14.23

|

|

Italy

|

91

|

5.4

|

Source: GACC

In terms of nonwovens products, the exports of masks and medical protective clothing continued to massively decline in 2023, but the exports of disposable diapers and sanitary napkins reached 3.32 billion US dollars, an increase of 11.7% year on year.

In 2023, China imported 820 million US dollars of nonwovens, a year-on-year decrease of 10.3%. Japan, the United States and Italy were the main sources of China's imports of nonwovens.

4. End-use market

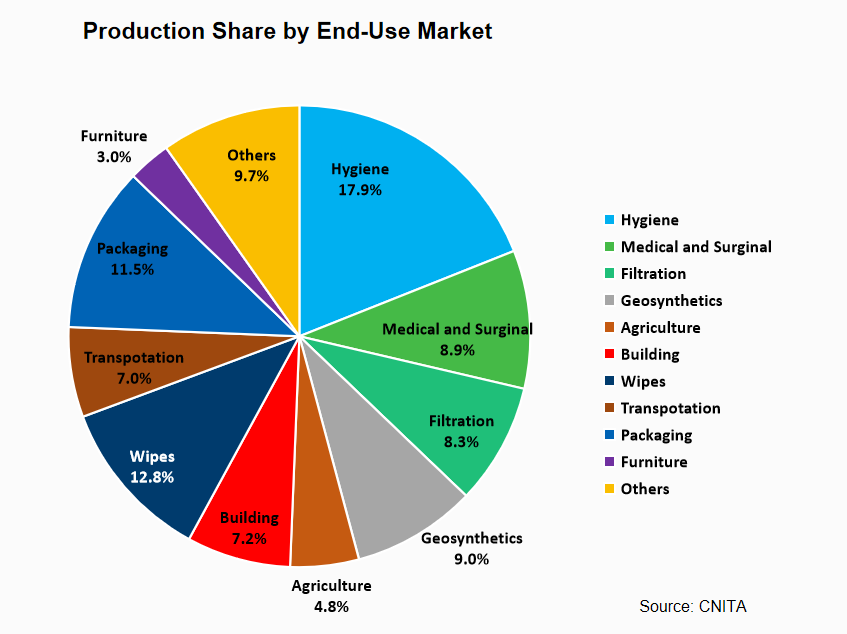

Absorbent hygiene, medical and surgical, wipes, building and construction, packaging, and automotive are the major applications of nonwovens in China. Absorbent hygiene products such as diapers, sanitary napkins, and adult incontinence supplies account for approximately 18% of the nonwovens use in China. With the decline of China's birth rate and the increase of market penetration of baby diapers and sanitary napkins, the demand for such products has become increasingly saturated. Overseas markets and adult incontinence supplies are new growth areas in this field in the future.

Nonwovens in the medical and surgical sector accounted for 9% of usage. The implementation of the Healthy China Initiative and the innovation of products and application will continue to drive the consumption of nonwovens in this field.

Packaging is a traditional important application field of nonwovens in China. With the restrictions on the use of plastic bags, the consumption of nonwoven shopping bags that can be reused multiple times has significantly increased. In addition, the application of nonwovens in clothing, shoes and luggage is also expanding. The performance requirements for nonwovens in the consumer packaging are not high, China's nonwovens industry will focus more on applications in industrial, medical and food packaging in the future.

Wipes is a fast-growing application area for nonwovens in China, with an average annual growth rate of over 15% in recent years, and accounting for 12.8% of China's nonwovens usage in 2023. The biodegradability and the low energy consumption of the production process will be the trends for wipes development, and will also be an important direction for technological innovation and market competition in the industry. The application scenarios of wipes continues to expand, consumer demand presents diversified, personalized and hierarchical characteristics.

Roads, railways, and water conservancy are also traditional application areas for nonwovens, consumption volume accounting for 9% of the total. China's infrastructure investment continues to be large in 2023. Geosynthetics companies were in full operation and their output continued to grow. Buildings’ usage accounted for 7.2% of the total in 2023.

In 2023, the consumption of nonwovens in filtration decreased by 2.3%, accounting for 8.3% of the total. Industrial fume filtration is the fastest growing sector of China's nonwovens filtration industry. Clean rooms, building air purification and machine air intake purification are also important application markets for the air filtration industry.

In 2023, the output and sales of automobiles in China grew by 11.6% and 12% year-on-year respectively, continued the growth trend, which drove the application of nonwovens in transportation to grow by 10.5%, accounting for 7% of total nonwovens consumption. In the future, consumers will pay more attention to the comfortability of cars, and the amount of nonwovens used in interior, sound and heat insulation will increase.

5. Outlook

In 2024, the positive factors driving the development of China's nonwovens industry remain unchanged, and the in-depth implementation of the strategies of Expanding Domestic Demand, Ecological Conservation and Environmental Protection, and Healthy China Initiative will still bring great opportunities to the nonwovens industry. However, China's nonwovens industry is also facing the challenges of the new-added production capacity release and the slowing demand in the medical and healthcare sector, which will intensify competition in the industry and weaken the profitability of companies.

In 2024, China's nonwovens industry will maintain the direction of high-end, intelligent and green development, focus on strengthening the innovation and sustainability, to ensure the high-quality development of the industry. In addition, we will boost the use of waste textiles in the production of nonwovens, and increase the use ratio of recycled fibers in nonwovens for end-use fields such as geosynthetics, building construction, transportation, packaging, and agriculture. and further increase the reusing amount of waste textiles in the nonwovens industry.

It is expected that the output and sales of China's nonwovens will resume steady growth, and companies profitability may improve in 2024. The growth rate of fixed asset investment is expected to pick up, and the investment of expanding production capacity will still tend to be cautious. The investment in intelligent and green manufacturing will continue to maintain growth. China's nonwovens exports will see a recovery.

About CNITA

CNITA, China Nonwovens and Industrial Textiles Association, is the only association approved by the Ministry of Civil Affairs of China, represents nonwovens, industrial textiles and related industries in China, and serves 1,000+ member companies. Since its founding in 2001, CNITA has provided a comprehensive range of services with networking events, educational courses, market data, standards, consultancy, information, publicity, etc. to help its members and the industry succeed. The main mission of CNITA is to preserve the rights and interests of its members, serve as a bridge between its members and government, and promote the high-quality development of China’s nonwovens and industrial textiles with continuous innovative services.

For more information, please contact:

Mr. Yang Yaolin

Mobile: +86 18810151929

Email: foreignaffairs@cnita.org.cn